XRP Price Prediction: Bullish Fundamentals Could Fuel Rebound Toward $3.65, Is Pullback a Buy Opportunity?

Ripple Ranks Among the World’s Most Valuable Private Companies

CB Insights’ latest data shows that Ripple has joined the ranks of the world’s most valuable private companies, boasting a valuation exceeding $15 billion and holding the 23rd position globally—just behind giants like SpaceX. This achievement underscores Ripple’s leading role in blockchain payments. It also further strengthens the value proposition of its native token, XRP.

Among the top 50 most valuable private companies in the United States, blockchain firms have secured a notable presence, with names such as OpenSea, Bitmain, and KuCoin represented. Ripple’s leadership among these enterprises stands out.

XRP Technicals Show Renewed Strength

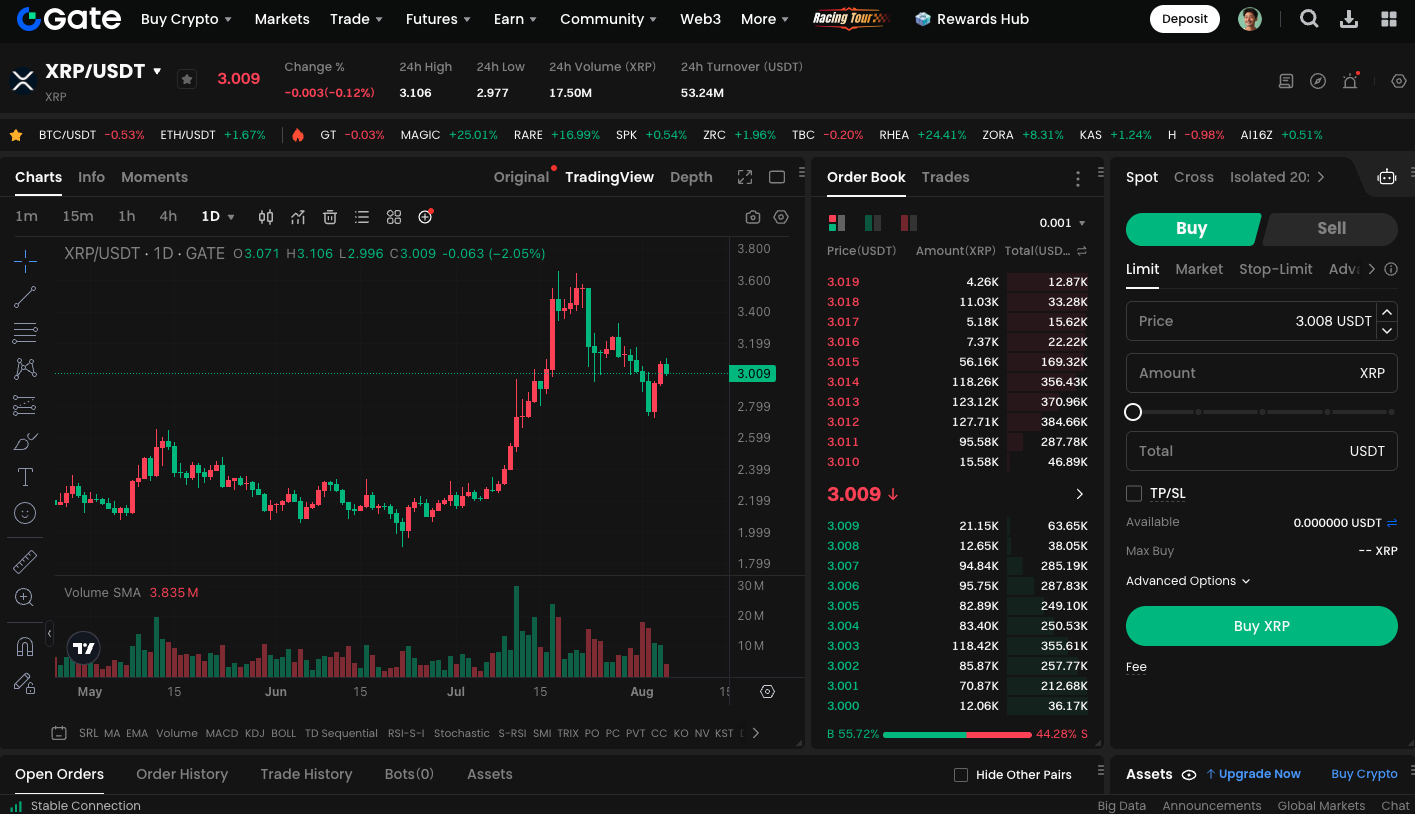

Technical analysis of the XRP/USDT daily chart reveals that after setting a recent high followed by a sharp pullback, XRP has steadily regained lost ground, establishing solid support near $2.8. Its current price is consolidating around $3, with room to move toward its historic peak at $3.65.

The Relative Strength Index (RSI) exhibits a pattern of progressively higher lows and highs, signaling increasing momentum. If XRP can break past initial resistance at $3.15, it may next test the crucial supply zone between $3.25 and $3.4. A daily close above $3.55 could pave the way for a renewed rally. Conversely, should the $2.8 support level give way, XRP may retreat to the $2.5–$2.6 range, which could draw in new buyers and provide a base for a potential rebound.

XRPL Decentralized Infrastructure Receives Another Upgrade

Ripple’s Chief Technology Officer, David Schwartz, recently announced he has personally returned to supporting the XRP Ledger (XRPL) infrastructure. At a New York data center, he deployed a high-spec server node featuring an AMD 9950X processor, 256GB of RAM, and a 10Gbps network connection, which is now fully synced with XRPL.

Schwartz designed this node to serve as a stable validator node and infrastructure hub, with select resources made available to public nodes and key validators. He emphasized that this is not a testing platform, but a robust system engineered to support the long-term stability of XRPL operations. This move should bolster community confidence in the XRP ecosystem.

You can access XRP spot trading here: https://www.gate.com/trade/XRP_USDT

Summary

While XRP faces short-term volatility, a combination of bullish catalysts—including Ripple’s substantial valuation, improving technicals, and enhanced decentralized infrastructure—means the market outlook is turning more optimistic. If XRP holds the $2.8 level and breaks through $3.15, it could once again attempt the historic high at $3.65. A pullback to lower ranges may give medium- and long-term investors an attractive entry point.