White House Crypto Report Incoming: Will the U.S. Government’s Bitcoin Holdings Be Revealed?

At 7:30 p.m. ET on July 30, a highly anticipated document for the crypto industry will be released: the White House’s first digital asset policy report. This marks not only the Trump administration’s initial comprehensive stance on cryptocurrency regulation but is also considered a potential roadmap for the industry’s trajectory in the years ahead.

This forthcoming report stands out amid a backdrop of legislative momentum and regulatory negotiations, with its impact likely to extend well beyond mere compliance.

Executive Order Drives Top-Down Strategy: The Story Behind Order 14178

In January, President Trump signed Executive Order 14178, officially establishing the Presidential Digital Asset Working Group, led by the Treasury Secretary. The group, comprised of key regulators like the SEC chair and Secretary of Commerce, is tasked with thoroughly evaluating the state of digital asset development and offering targeted policy recommendations.

Now, after 180 days of preparation, this landmark report is on the verge of release. Bo Hines, Executive Director of Crypto Affairs for the White House, confirmed on social media that it will be officially published on July 30, stating, “The United States is leading the global trend in digital asset policy.”

The timing is highly strategic—major legislative efforts like the GENIUS Act and CLARITY Act are making real headway. This combined movement of executive action and legislative advancement sends a clear message: the U.S. is no longer on the sidelines but is now proactively shaping the governance of digital assets.

Industry Focus: The Dawn of Clear Regulatory Frameworks

After years of regulatory ambiguity and fragmented oversight, the crypto industry’s chief expectation for this report is clarity and well-defined boundaries.

Cody Carbone, CEO of the Digital Chamber of Commerce, describes it as “the foundational document for all regulations and guidance over the next three and a half years.”

The report will likely focus on four major areas:

- Stablecoin Regulatory Framework

It is expected to propose requirements for issuing USD-pegged stablecoins, reserve mechanisms, and audit transparency—providing a framework for the expanding stablecoin market. - Bank Access and Integration Mechanisms

On issues like bank accounts and payment channels for crypto companies, the report is poised to suggest policies for integrating crypto businesses with traditional finance, while also enhancing risk barriers. - National Security Perspective

To address risks of cross-border transactions, sanctions evasion, and money laundering, the report will push for compliance technology solutions that align with regulatory needs. - Technology Neutrality and Clear Regulatory Boundaries

The dominant theme is likely to be regulating based on function instead of on technology, clarifying agency jurisdiction and resolving chronic issues like overlapping authority and regulatory gaps.

Carbone points out that providing clear “do’s and don’ts” would significantly boost industry confidence.

The Holdings Puzzle: How Much BTC Does the U.S. Government Really Hold?

Beyond a regulatory blueprint, the report’s other highly anticipated section is the first official disclosure on U.S. government crypto holdings.

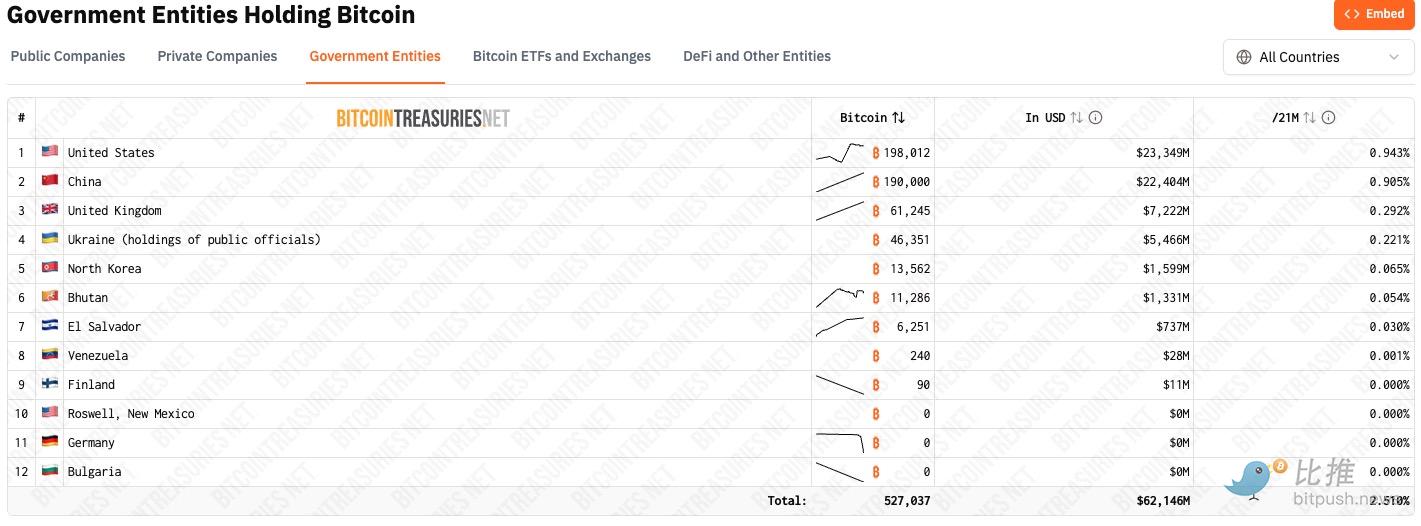

For years, online speculation claimed the U.S. government was the world’s biggest Bitcoin holder. According to BitcoinTreasuries, it holds roughly 198,000 BTC—far more than any other country.

But when independent journalist L0la L33tz used the Freedom of Information Act (FOIA) to request holdings data from the Department of Justice, the response showed only 28,988 BTC under DOJ control. This number fell far short of market expectations, raising questions: “Did nearly 170,000 BTC get sold?” (See details in this article: Did U.S. Marshals Secretly Sell 170,000 BTC? Is a Massive Buyback Coming?)

Community member Shifu Dumo offered a more neutral explanation: the FOIA data only shows the DOJ-affiliated U.S. Marshals Service’s liquid assets. Some BTC may have been frozen, used as victim compensation, or be under control of other agencies, and thus not included in DOJ disclosures.

This suggests the actual amount of Bitcoin available to the U.S. federal government as a “national strategic reserve” could be much lower than publicly believed.

Crypto commentator “The ₿itcoin Therapist” publicly asked Bo Hines, White House Executive Director for Crypto Affairs: “How much Bitcoin does the U.S. government hold? Isn’t this level of transparency important?” This sentiment reflects the community’s demand for clarity.

The soon-to-be-released report is expected to clarify the U.S. government’s real Bitcoin holdings and offer official explanations for the “missing” coins, potentially resolving a long-standing market concern.

Industry Reaction: Entering the “Adoption Phase”

The industry response is overwhelmingly positive. Summer Mersinger, CEO of the Blockchain Association, believes this report demonstrates that the crypto-focused executive order is moving into practical execution.

Ron Hammond, Head of Policy at Wintermute, calls the report “an important step in Trump upholding his promises to the crypto industry.”

Jordi Visser, Managing Director at 22V Research, says the crypto sector is hitting an inflection point—from “experimenting” to “mainstream adoption”—likening this to crypto’s “ChatGPT moment.”

With regulatory clarity brightening and institutional adoption accelerating, Bitcoin has rallied sharply, briefly exceeding $120,000. At press time, it remains above $117,000, with a total market cap of $3.85 trillion.

This report is not just a systematic summary of Trump administration crypto policies; it marks a pivotal moment for the global crypto market. Can it strike the right balance between encouraging innovation and managing risk? Will it restore trust in America’s reserve strategy? Answers are imminent.

Disclaimer:

- This article is republished from [bitpush]. Copyright remains with the original author [bitpush]. If you object to this republication, please contact the Gate Learn team, and they will handle your request according to established procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice of any kind.

- Other language versions were translated by the Gate Learn team. Unless authorized by Gate, translated articles may not be reproduced, distributed, or plagiarized in any form.