TREE Price Prediction: Treehouse Eyes $0.52 Resistance If $0.47 Support Holds Strong

What is Treehouse?

With the fixed-income crypto asset sector rapidly evolving, Treehouse Protocol has recently come into the spotlight. Its flagship product, tETH, is a liquid staking token for Ethereum that enables users to earn interest at on-chain rates while participating in DeFi strategies. This approach eliminates the inconvenience of traditional staking lockups and introduces a new yield model to the Ethereum ecosystem.

Treehouse has also introduced a decentralized interest rate consensus mechanism called DOR (Decentralized Offered Rates). This system aims to establish a market benchmark rate for crypto similar to those in traditional finance, paving the way for a broader range of fixed-income products.

TREE Added to Binance VIP Collateral Portfolio

On the application front, Binance recently announced it is expanding its VIP Loan service by officially adding emerging tokens like TREE and A2Z to the collateral eligibility list. These additions come with personalized interest rates and high borrowing limits. This upgrade is designed for professional investors, boosting capital flexibility for activities such as leveraged trading, arbitrage, and hedging. Key highlights of the initiative include:

- Adding TREE, A2Z, KERNEL, SPK, and others as collateral, increasing asset diversity;

- Enabling real-time dynamic interest rates and flexible fund flows;

- Binance tailors loan terms based on VIP users’ risk tolerance;

- Improving portfolio efficiency and offering greater flexibility in collateral management ratios.

These enhancements not only further cement Binance’s leadership in the crypto lending space but also boost TREE’s market visibility and demand.

TREE Price Overview

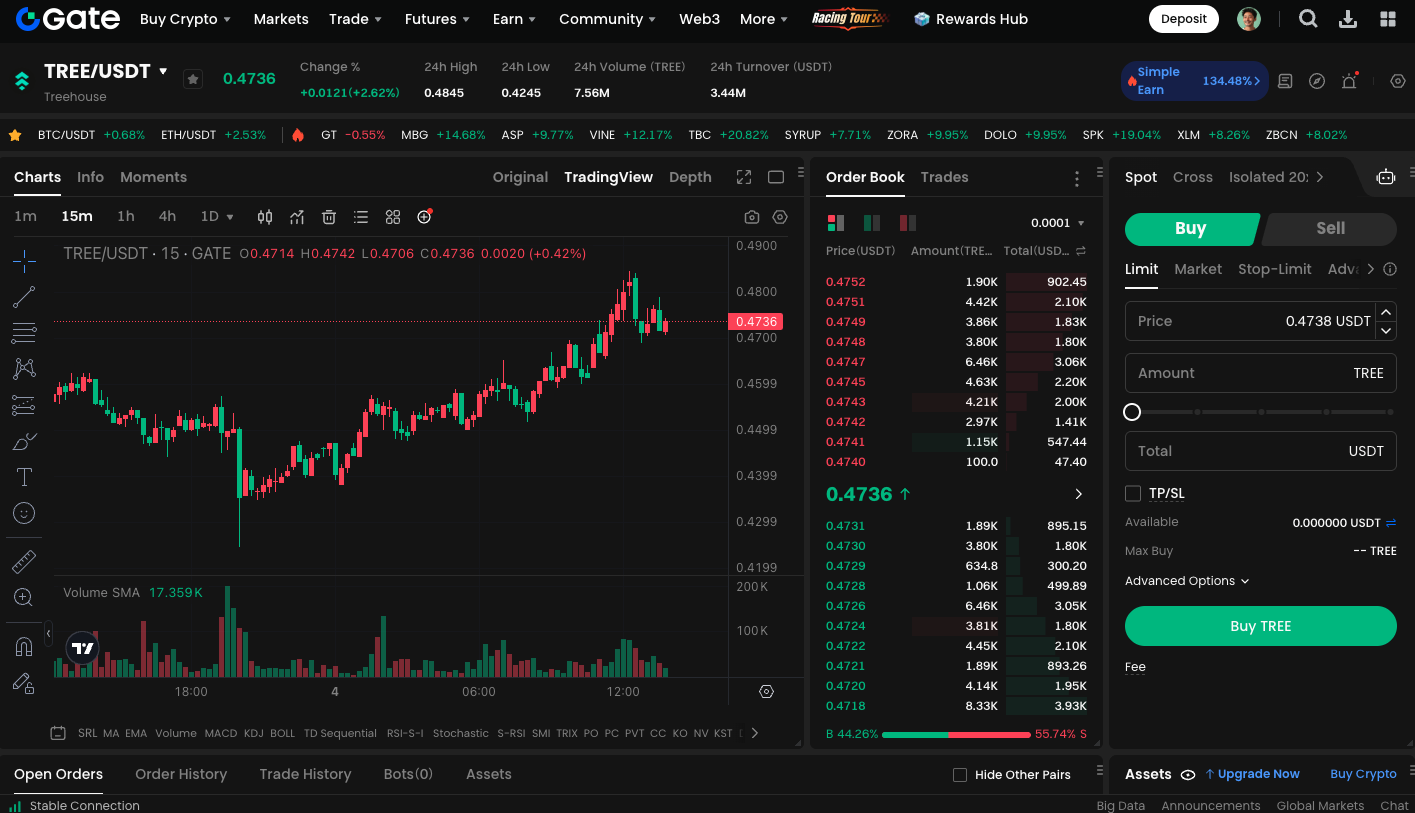

As of this writing, TREE is trading at approximately $0.47. If the $0.47 support level holds, it could set the stage for a move toward the next resistance area at $0.52. From a technical perspective, if capital inflows persist and the price breaks through the resistance range, there may be an opportunity for a larger rebound. Conversely, if $0.47 fails, the price could retest previous lows. Investors should closely monitor overall market sentiment and liquidity in the short term.

To start trading TREE spot, visit: https://www.gate.com/trade/TREE_USDT

Summary

Leveraging its innovative financial framework and robust technical underpinnings, Treehouse Protocol is expanding its presence in the Ethereum fixed-income market. Backed by Binance’s inclusion of TREE in its premium lending services and the token’s performance at key support levels, TREE is positioned as a promising asset to track capital flows and market sentiment in the near term. Whether TREE can break through the $0.52 resistance will depend on institutional engagement and broader market conditions. Investors should closely monitor its ongoing developments.